As the owners of a commercial truck in North Dakota, you are committed to the safety and well being of all your employees and passengers. Commercial trucks are large and often dangerous, which is why you should always operate at the highest standard.

As the owners of a commercial truck in North Dakota, you are committed to the safety and well being of all your employees and passengers. Commercial trucks are large and often dangerous, which is why you should always operate at the highest standard.

Every vehicle on the road in North Dakota needs insurance to meet minimum legal requirements, but commercial trucks may need additional coverage to protect their businesses. This type of insurance is required by federal and state law, and whether you want it is up to you.

What is commercial truck insurance?

Commercial truck insurance is essential to your business. It’s a way to protect your assets and make sure they don’t get stolen, stolen or damaged. It’s also a way to make sure your employees are protected if they’re involved in an accident.

Insurance is a vital part of any business or individual’s financial safety net. It can be a tricky thing to navigate, however, since many policies can be confusing. If you own a commercial vehicle, you will want to make sure you have proper commercial truck insurance in place. Below are a few tips to get you started.

Who needs commercial truck insurance

Commercial truck insurance is important for any business that uses a truck for transportation. It allows you to transport your goods from one point to another, in compliance with traffic laws and regulations.

If you own a commercial truck, you need commercial truck insurance. The reason is simple: you cannot afford to be without it. If you don’t already have it, your commercial truck may be called into action, and it will be your only asset if you need to quickly get it to a certain place or to a customer. It is important to ensure that you have commercial truck insurance.

Commercial Truck Insurance for North Dakota Drivers

Commercial trucking is a major industry in the United States, and it is growing. According to the latest data from the U.S. Department of Transportation, the number of commercial freight trucks traveling on U.S. roads is at its highest level since the late 1990s. And while this growth can be attributed to the popularity of online retail, air transportation and delivery services, the number of drivers is also rising.

Commercial trucking is a major industry in the United States, and it is growing. According to the latest data from the U.S. Department of Transportation, the number of commercial freight trucks traveling on U.S. roads is at its highest level since the late 1990s. And while this growth can be attributed to the popularity of online retail, air transportation and delivery services, the number of drivers is also rising.

With North Dakota’s increasing number of trucks on the road, it is no surprise that more and more trucking companies are advertising their services for truckers. The problem is that many of these companies are offering worthless insurance packages. If you would like to know what you are getting yourself into, then first look at the kind of policy your prospective insurance agent is offering. If you see any of the following three types of policies, then you may want to reconsider your decision to go with that company. – General Liability – This type of policy covers all damages which are the result of any accident. If the trucker is not paying attention, then he or she is not covered.

INSURANDE FOR ALL CITIES IN NORTH DAKOTA

We offer truck insurance in all cities in North Dakota, which include the following:

|

|

|

ND Truck Insurance Coverage

Cover Me Insurance Agency offers a full line of coverage especially designed for the North Dakota trucking industry, including but not limited to:

- Auto Liability

- Non-Trucking (Bobtail Liability)

- General Liability

- Motor Truck Cargo or Commercial Cargo Insurance

- Physical Damage

- Trailer Interchange

- Workers Compensation

Types Of Commercial Truck / Trailers covered by Cover Me Insurance Agency

When searching for insurance coverage for your commercial truck, we know what you’re thinking: “I need a safety net for my business, so I’m going to need the best coverage possible.” And if that thought is running through your mind, we want to help you out. In just a couple short minutes, we’ll give you a complete breakdown of the different ways you can cover your truck, from the specific coverage types to how much you are actually paying for your coverage.

We cover all truck and all sizes. Some of the trucks we cover are:

|

|

|

How much does North Dakota commercial truck insurance cost?

Commercial insurance premiums are on the rise again, but the reason is not a new increase in auto insurance claims. The real reasons are that the economy’s health is growing again, and that the industry is becoming more competitive. North Dakota has become the envy of the nation; the state ranked first for average commercial truck insurance premiums in the country.

There are many factors that go into the cost of truck insurance in North Dakota. With some being obvious and others not so much, it’s hard to give an exact answer as to how much it will cost you. Whether you are a person who works in the field, or an employer whose employees need to be taken care of, you can feel secure that your business is protected by a comprehensive policy from Cover Me Insurance Agency. We are a North Dakota Commercial Truck Insurance agency that is here to protect you.

How to be covered under a commercial truck insurance policy in ND

In the United States, commercial truck drivers have a unique set of insurance needs. You are required to have truck insurance as part of your license as long as you are driving a commercial vehicle. This type of insurance covers damage to your vehicle in the event of an accident and is required by the Federal Motor Carrier Safety Administration.

As many of you know, getting commercial truck insurance coverage is tricky business. There are just so many details to take into consideration when shopping for coverage. In order to ensure you have the right coverage for your business, it is important that you do your homework before you purchase commercial truck insurance. Our commercial truck insurance agents are ready to help you find the right coverage at the right price.

What To Look For When Choosing A Truck Insurance Agent

When you are searching for a new Truck Insurance Agent, there are many things that you should look for in an agent. As with any good relationship, as with any type of insurance, you will want to find an agent that has a history of being able to help you with your insurance needs.

It can be difficult to choose the right insurance agent to work with when it comes to your commercial truck insurance policy. After all, you want someone who can answer any questions you might have in an expedient manner. However, what is important to remember is that when it comes to the insurance industry, it is the agent who represents your best interests, not the insurance company. As such, it is important to find someone who will take care of your business in the best possible way.

Benefits of commercial truck insurance in North Dakota

The trucking industry is a huge $28 billion dollar industry in the U.S. It plays a vital role in our economy as a motor of transportation, and also provides jobs for thousands of people. Trucking holds a special place in the heart of many Americans, and protects the industry from a number of different threats.

The trucking industry is a huge $28 billion dollar industry in the U.S. It plays a vital role in our economy as a motor of transportation, and also provides jobs for thousands of people. Trucking holds a special place in the heart of many Americans, and protects the industry from a number of different threats.

Commercial truck insurance is a must for anyone who owns a commercial vehicle. It’s the only way to protect yourself if a truck gets written off in an accident and you’re left with a truck that’s worth less than your insurance deductible. This may sound like a problem, but it’s actually a blessing in disguise. Instead of paying out of pocket for expensive truck repairs, you can take your commercial vehicle to an insurance company, and they’ll repair or replace it for you.

Commercial truck insurance for small business owners in ND

Your business relies on trucks to deliver your products. But are you covered if they are damaged or stolen? Trucks are expensive, but insuring them can be costly. That’s why we provide commercial truck insurance designed to protect your company.

In North Dakota, commercial truck insurance is required by law and available through the state’s insurance department, but you can find many different companies offering different coverage, prices, and policies. Commercial truck insurance is also a good idea for many businesses because it covers the cost of property damage and accidental damage to the insured vehicle.

How to Get Cheap Commercial Truck Insurance in North Dakota

In North Dakota, there are also several different companies that can provide you with commercial truck insurance. The best way to get the best deal is to shop around and compare quotes. Go for an independent agent, who will be able to provide you with the best price for your truck insurance.

If you’re looking for cheap commercial truck insurance in North Dakota, you want to check out Cover Me Insurance Agency. We’ve got the lowest rates around, and it spans from commercial truck insurance to commercial truck insurance for used vehicles. We’ll work with you to find the best coverage at the best price, and if you need help selecting the right commercial truck insurance, we’re here to help.

Why choose Cover Me Insurance Agency

Trucking is a very large part of the economy in North Dakota, and we have a lot of truckers who like to travel the state. One of the biggest problems that they have is their truck being parked and not being used in North Dakota. Truckers have a lot of things that they need to buy and do while they are away.

At Cover Me Insurance Agency, we are dedicated to making sure our customers are insured in a timely and affordable manner. We have built a reputation for providing top-notch service through a personalized approach and do not settle for anything less than the best. We specialize in insurance for the small and medium sized trucking companies of North Dakota and are here to assist your company in every way we can.

Cover Me Insurance Agency has an experienced staff with over 20 years experience that are ready to help with all your truck insurance needs in all 50 states.

Contact us if you are looking for a truck insurance policy, semi insurance policy, owner operator insurance policy, fleet insurance policy, or a motor truck cargo insurance policy. Give us a call today at 1-800-726-8376 or fill out our free quote form and we will promptly get back to you.

If you own a trucking company in North Carolina, you’re going to need commercial truck insurance. This coverage protects you and your company from a wide range of possible risk. By purchasing commercial truck insurance, you are essentially protecting your livelihood, since being uninsured could result in serious financial consequences, such as fines, lawsuits, and jail time.

If you own a trucking company in North Carolina, you’re going to need commercial truck insurance. This coverage protects you and your company from a wide range of possible risk. By purchasing commercial truck insurance, you are essentially protecting your livelihood, since being uninsured could result in serious financial consequences, such as fines, lawsuits, and jail time.

Commercial trucking is one of the safest forms of transportation in our country, but that doesn’t mean everyone has the same level of insurance coverage. Commercial truck insurance varies between companies, states, and policies. Be sure to check out the details of what is covered and what isn’t, before you buy.

Commercial trucking is one of the safest forms of transportation in our country, but that doesn’t mean everyone has the same level of insurance coverage. Commercial truck insurance varies between companies, states, and policies. Be sure to check out the details of what is covered and what isn’t, before you buy.

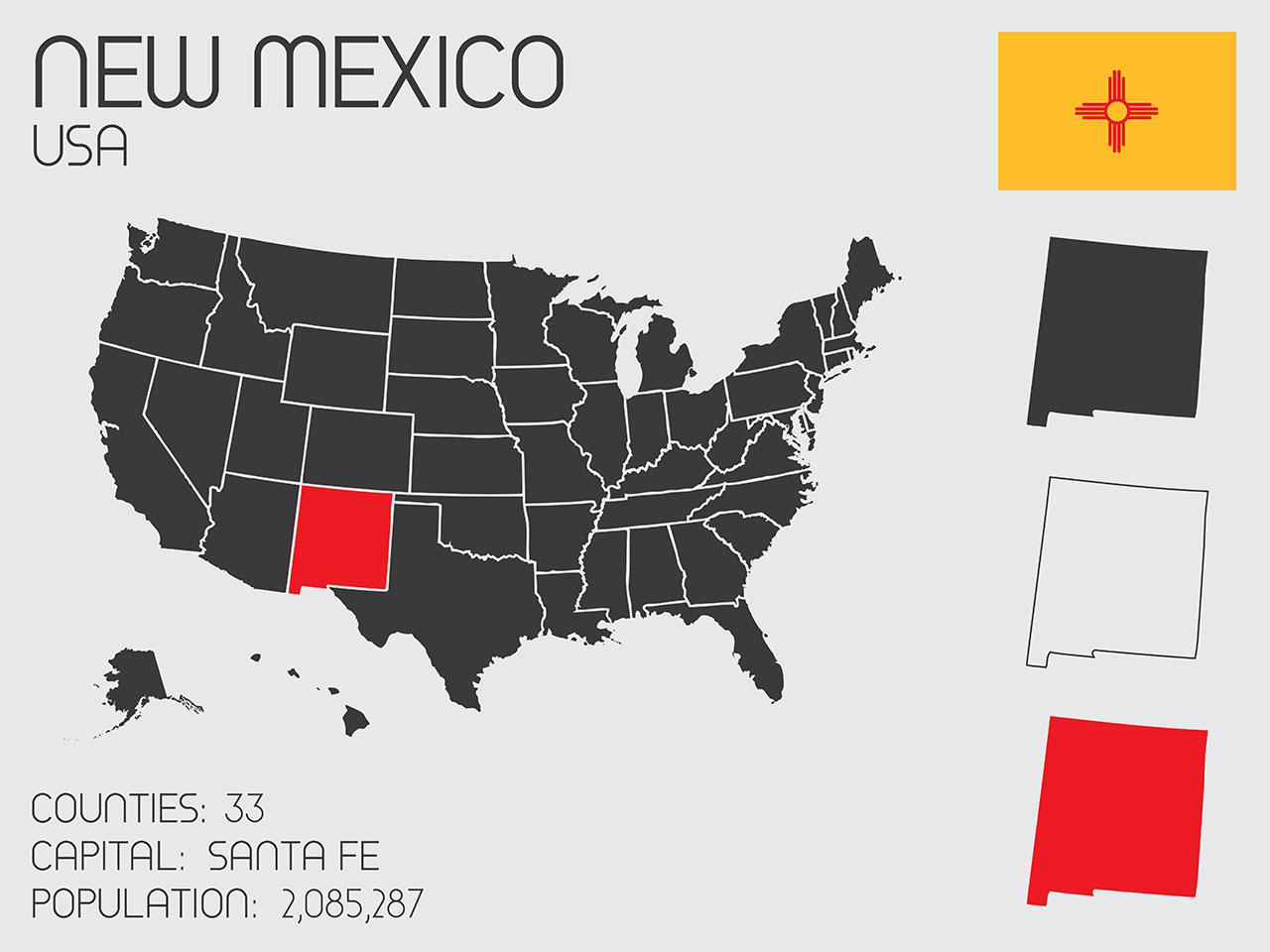

New Mexico is famous for its breathtaking scenery, decadent culinary options, and incredible outdoor attractions. Whether it’s taking a scenic drive through the Gila National Forest or visiting Santa Fe or Albuquerque, New Mexico offers something for everyone. Of course, driving holidays in New Mexico are a great experience when you have the proper insurance coverage.

New Mexico is famous for its breathtaking scenery, decadent culinary options, and incredible outdoor attractions. Whether it’s taking a scenic drive through the Gila National Forest or visiting Santa Fe or Albuquerque, New Mexico offers something for everyone. Of course, driving holidays in New Mexico are a great experience when you have the proper insurance coverage.

Commercial trucking insurance is more complex than insuring a regular car, and your commercial trucking insurance company will have several additional coverages available to give you as much protection as possible. These coverages depend on the type of goods you carry, your driving habits, and how often you drive.

Commercial trucking insurance is more complex than insuring a regular car, and your commercial trucking insurance company will have several additional coverages available to give you as much protection as possible. These coverages depend on the type of goods you carry, your driving habits, and how often you drive.

Commercial trucking isn’t cheap, so when the trucking company you’re working for needs a commercial truck insurance policy, it’s obvious that there will be extra costs involved. But, how do you determine the proper commercial truck insurance levels? According to NMEDA, “Insurance providers often require you to maintain the minimum level of liability insurance required in each state in which you operate. These minimums are pre-determined by the state and are usually good for two years. You should check with your insurance agent or company to see what your state’s minimums are.”

Commercial trucking isn’t cheap, so when the trucking company you’re working for needs a commercial truck insurance policy, it’s obvious that there will be extra costs involved. But, how do you determine the proper commercial truck insurance levels? According to NMEDA, “Insurance providers often require you to maintain the minimum level of liability insurance required in each state in which you operate. These minimums are pre-determined by the state and are usually good for two years. You should check with your insurance agent or company to see what your state’s minimums are.”

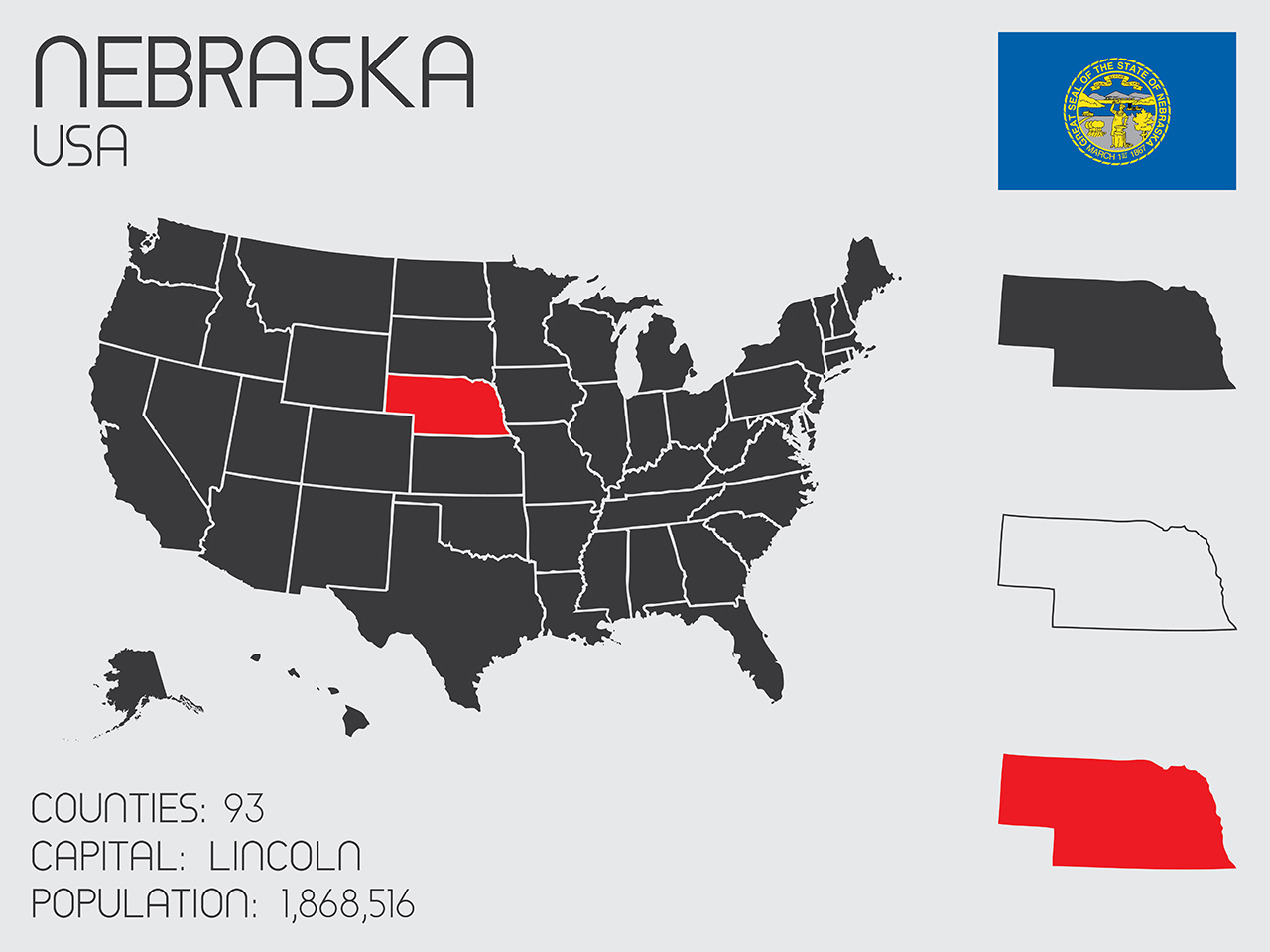

Commercial trucks are involved in more traffic accidents than any other vehicles on the road. The size and weight of a commercial truck can cause devastating injuries and even death to other drivers, passengers, and pedestrians. According to the Nebraska Department of Motor Vehicles, truck-related crashes accounted for 21 percent of all fatal crashes and 12 percent of all injury crashes between 2012 and 2015.

Commercial trucks are involved in more traffic accidents than any other vehicles on the road. The size and weight of a commercial truck can cause devastating injuries and even death to other drivers, passengers, and pedestrians. According to the Nebraska Department of Motor Vehicles, truck-related crashes accounted for 21 percent of all fatal crashes and 12 percent of all injury crashes between 2012 and 2015.

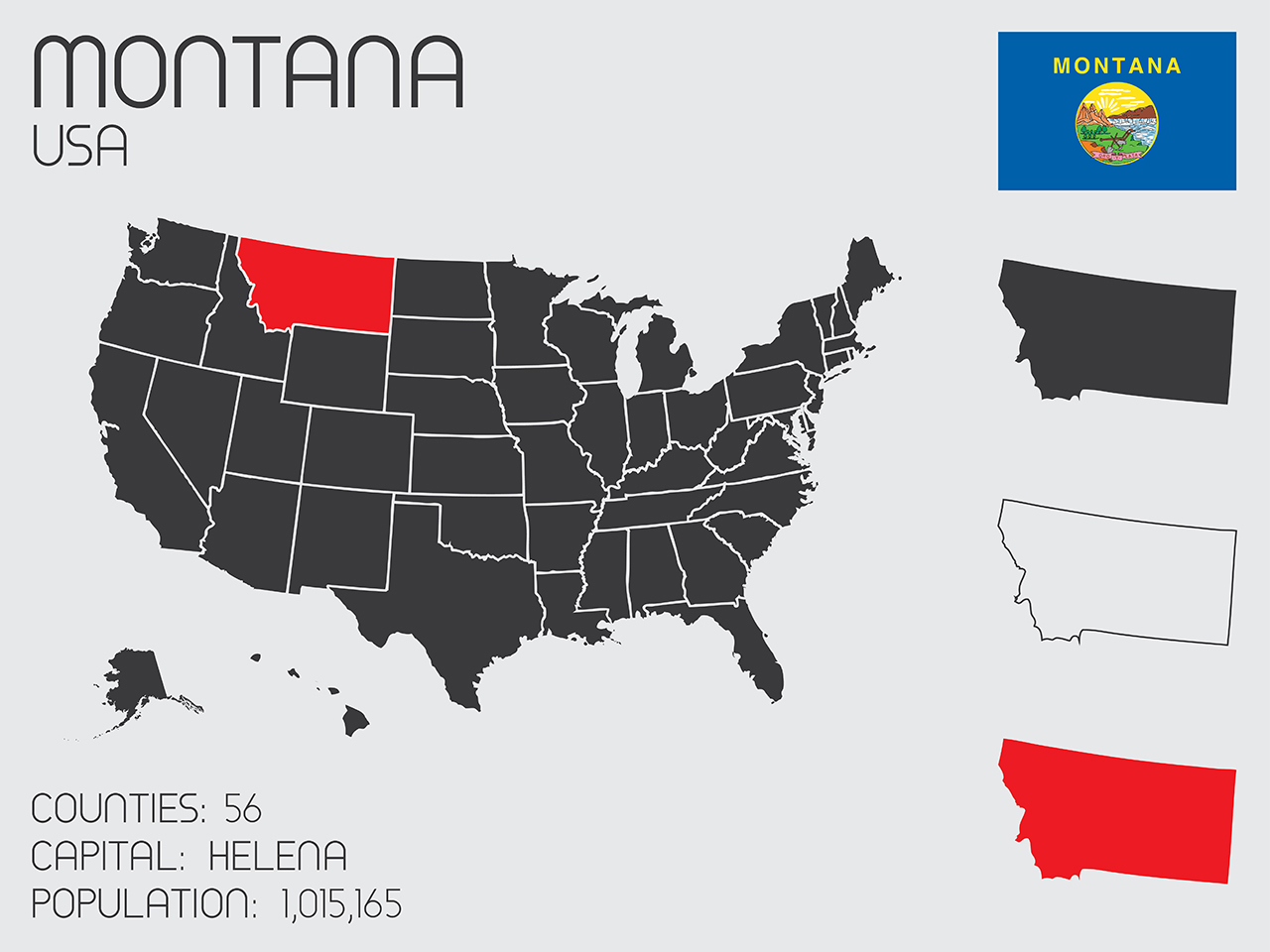

Commercial trucks are large and dangerous vehicles. It’s essential for companies to protect both their workers and the communities they travel through. Commercial trucks use more fuel than passenger vehicles, and they often travel longer distances than their passenger counterpart. Because of the danger associated with such vehicles, Montana requires commercial truck owners to acquire commercial truck insurance.

Commercial trucks are large and dangerous vehicles. It’s essential for companies to protect both their workers and the communities they travel through. Commercial trucks use more fuel than passenger vehicles, and they often travel longer distances than their passenger counterpart. Because of the danger associated with such vehicles, Montana requires commercial truck owners to acquire commercial truck insurance.

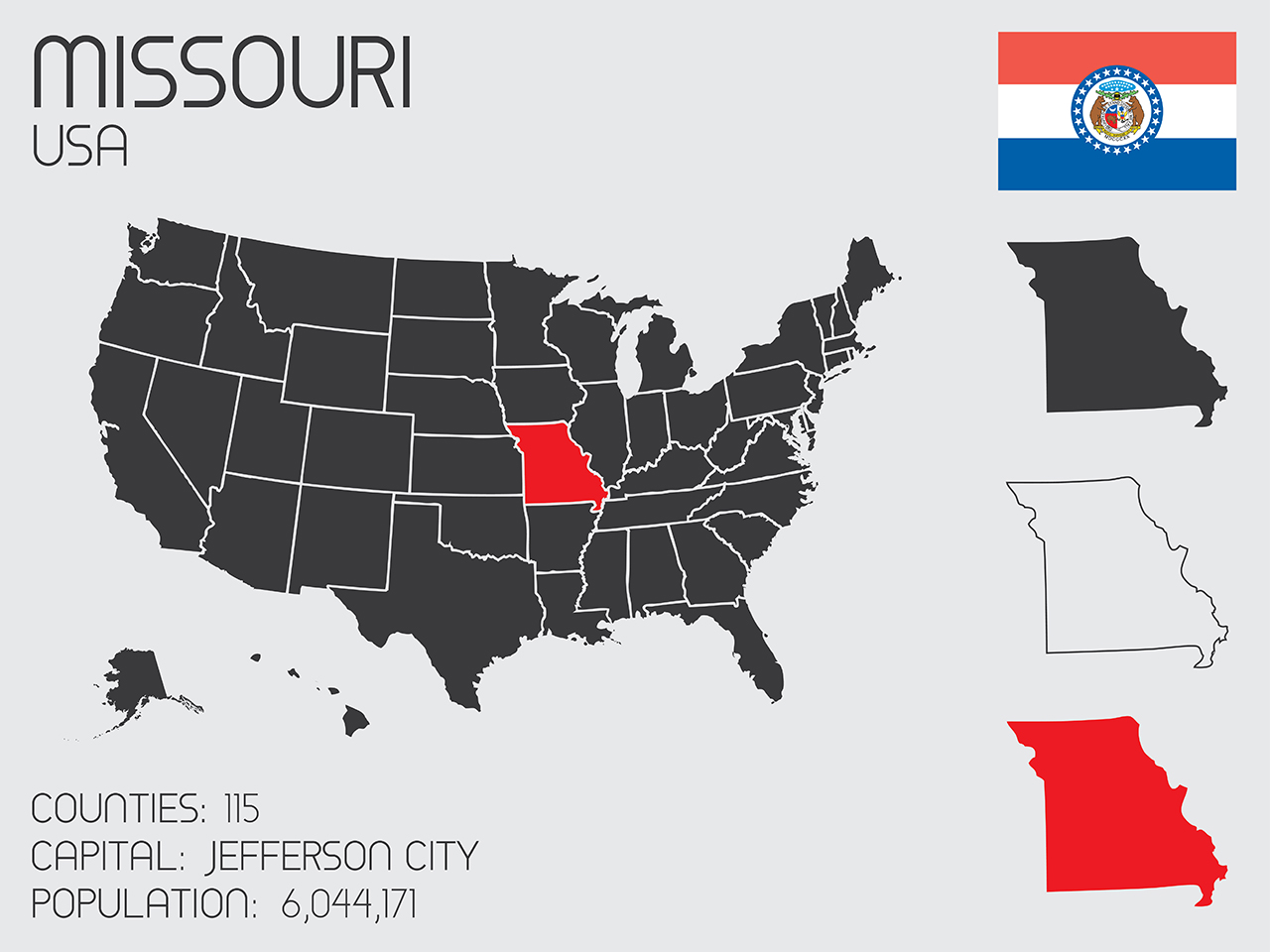

Driving any commercial vehicle (including tractor-trailers) in Missouri entails a lot of responsibility, including making sure you meet the requirements of the state’s Commercial Driver’s License (CDL) program. And, of course, you also have to make sure that you’re meeting any mandatory commercial vehicle insurance requirements.

Driving any commercial vehicle (including tractor-trailers) in Missouri entails a lot of responsibility, including making sure you meet the requirements of the state’s Commercial Driver’s License (CDL) program. And, of course, you also have to make sure that you’re meeting any mandatory commercial vehicle insurance requirements.

Transportation companies in Mississippi use some of the largest trucks in the country, and these trucks can be quite expensive to replace. As a result, a trucker’s insurance costs in Mississippi tend to be much higher than they are in most places.

Transportation companies in Mississippi use some of the largest trucks in the country, and these trucks can be quite expensive to replace. As a result, a trucker’s insurance costs in Mississippi tend to be much higher than they are in most places.