If you’re a Vermont business owner, you know the importance of getting a commercial truck insurance policy to protect your business from unexpected liabilities. If you own a truck, you need commercial vehicle insurance, and you need a commercial truck insurance quote.

If you’re a Vermont business owner, you know the importance of getting a commercial truck insurance policy to protect your business from unexpected liabilities. If you own a truck, you need commercial vehicle insurance, and you need a commercial truck insurance quote.

When it comes to commercial truck insurance, no one wants to pay more than they have to. While many people think that commercial trucks are more expensive than personal ones, in fact, they are actually less pricey. Of course, the type of truck you drive, the miles you drive, and the type of cargo you haul all factor into the overall cost, but in general, car insurance for commercial trucks tends to be pretty affordable.

What is commercial truck insurance?

Commercial truck insurance is essential to your business. It’s a way to protect your assets and make sure they don’t get stolen, stolen or damaged. It’s also a way to make sure your employees are protected if they’re involved in an accident.

Insurance is a vital part of any business or individual’s financial safety net. It can be a tricky thing to navigate, however, since many policies can be confusing. If you own a commercial vehicle, you will want to make sure you have proper commercial truck insurance in place. Below are a few tips to get you started.

Who needs commercial truck insurance

Commercial truck insurance is important for any business that uses a truck for transportation. It allows you to transport your goods from one point to another, in compliance with traffic laws and regulations.

If you own a commercial truck, you need commercial truck insurance. The reason is simple: you cannot afford to be without it. If you don’t already have it, your commercial truck may be called into action, and it will be your only asset if you need to quickly get it to a certain place or to a customer. It is important to ensure that you have commercial truck insurance.

Commercial Truck Insurance for Vermont Drivers

Commercial trucking is a major industry in the United States, and it is growing. According to the latest data from the U.S. Department of Transportation, the number of commercial freight trucks traveling on U.S. roads is at its highest level since the late 1990s. And while this growth can be attributed to the popularity of online retail, air transportation and delivery services, the number of drivers is also rising.

Commercial trucking is a major industry in the United States, and it is growing. According to the latest data from the U.S. Department of Transportation, the number of commercial freight trucks traveling on U.S. roads is at its highest level since the late 1990s. And while this growth can be attributed to the popularity of online retail, air transportation and delivery services, the number of drivers is also rising.

With Vermont’s increasing number of trucks on the road, it is no surprise that more and more trucking companies are advertising their services for truckers. The problem is that many of these companies are offering worthless insurance packages. If you would like to know what you are getting yourself into, then first look at the kind of policy your prospective insurance agent is offering. If you see any of the following three types of policies, then you may want to reconsider your decision to go with that company. – General Liability – This type of policy covers all damages which are the result of any accident. If the trucker is not paying attention, then he or she is not covered.

INSURANCE FOR ALL CITIES IN VERMONT

We offer truck insurance in all cities in Vermont, which include the following:

|

|

|

VT Truck Insurance Coverage

Cover Me Insurance Agency offers a full line of coverage especially designed for the Vermont trucking industry, including but not limited to:

- Auto Liability

- Non-Trucking (Bobtail Liability)

- General Liability

- Motor Truck Cargo or Commercial Cargo Insurance

- Physical Damage

- Trailer Interchange

- Workers Compensation

Types Of Commercial Truck / Trailers covered by Cover Me Insurance Agency

When searching for insurance coverage for your commercial truck, we know what you’re thinking: “I need a safety net for my business, so I’m going to need the best coverage possible.” And if that thought is running through your mind, we want to help you out. In just a couple short minutes, we’ll give you a complete breakdown of the different ways you can cover your truck, from the specific coverage types to how much you are actually paying for your coverage.

We cover all truck and all sizes. Some of the trucks we cover are:

|

|

|

How much does Vermont commercial truck insurance cost?

Commercial insurance premiums are on the rise again, but the reason is not a new increase in auto insurance claims. The real reasons are that the economy’s health is growing again, and that the industry is becoming more competitive. Vermont has become the envy of the nation; the state ranked first for average commercial truck insurance premiums in the country.

There are many factors that go into the cost of truck insurance in Vermont. With some being obvious and others not so much, it’s hard to give an exact answer as to how much it will cost you. Whether you are a person who works in the field, or an employer whose employees need to be taken care of, you can feel secure that your business is protected by a comprehensive policy from Cover Me Insurance Agency. We are a Vermont Commercial Truck Insurance agency that is here to protect you.

How to be covered under a commercial truck insurance policy in VT

In the United States, commercial truck drivers have a unique set of insurance needs. You are required to have truck insurance as part of your license as long as you are driving a commercial vehicle. This type of insurance covers damage to your vehicle in the event of an accident and is required by the Federal Motor Carrier Safety Administration.

As many of you know, getting commercial truck insurance coverage is tricky business. There are just so many details to take into consideration when shopping for coverage. In order to ensure you have the right coverage for your business, it is important that you do your homework before you purchase commercial truck insurance. Our commercial truck insurance agents are ready to help you find the right coverage at the right price.

What To Look For When Choosing A Truck Insurance Agent

When you are searching for a new Truck Insurance Agent, there are many things that you should look for in an agent. As with any good relationship, as with any type of insurance, you will want to find an agent that has a history of being able to help you with your insurance needs.

It can be difficult to choose the right insurance agent to work with when it comes to your commercial truck insurance policy. After all, you want someone who can answer any questions you might have in an expedient manner. However, what is important to remember is that when it comes to the insurance industry, it is the agent who represents your best interests, not the insurance company. As such, it is important to find someone who will take care of your business in the best possible way.

Benefits of commercial truck insurance in Vermont

The trucking industry is a huge $28 billion dollar industry in the U.S. It plays a vital role in our economy as a motor of transportation, and also provides jobs for thousands of people. Trucking holds a special place in the heart of many Americans, and protects the industry from a number of different threats.

The trucking industry is a huge $28 billion dollar industry in the U.S. It plays a vital role in our economy as a motor of transportation, and also provides jobs for thousands of people. Trucking holds a special place in the heart of many Americans, and protects the industry from a number of different threats.

Commercial truck insurance is a must for anyone who owns a commercial vehicle. It’s the only way to protect yourself if a truck gets written off in an accident and you’re left with a truck that’s worth less than your insurance deductible. This may sound like a problem, but it’s actually a blessing in disguise. Instead of paying out of pocket for expensive truck repairs, you can take your commercial vehicle to an insurance company, and they’ll repair or replace it for you.

Commercial truck insurance for small business owners in VT

Your business relies on trucks to deliver your products. But are you covered if they are damaged or stolen? Trucks are expensive, but insuring them can be costly. That’s why we provide commercial truck insurance designed to protect your company.

In Vermont, commercial truck insurance is required by law and available through the state’s insurance department, but you can find many different companies offering different coverage, prices, and policies. Commercial truck insurance is also a good idea for many businesses because it covers the cost of property damage and accidental damage to the insured vehicle.

How to Get Cheap Commercial Truck Insurance in Vermont

In Vermont, there are also several different companies that can provide you with commercial truck insurance. The best way to get the best deal is to shop around and compare quotes. Go for an independent agent, who will be able to provide you with the best price for your truck insurance.

If you’re looking for cheap commercial truck insurance in Vermont, you want to check out Cover Me Insurance Agency. We’ve got the lowest rates around, and it spans from commercial truck insurance to commercial truck insurance for used vehicles. We’ll work with you to find the best coverage at the best price, and if you need help selecting the right commercial truck insurance, we’re here to help.

Why choose Cover Me Insurance Agency

Trucking is a very large part of the economy in Vermont, and we have a lot of truckers who like to travel the state. One of the biggest problems that they have is their truck being parked and not being used in Vermont. Truckers have a lot of things that they need to buy and do while they are away.

At Cover Me Insurance Agency, we are dedicated to making sure our customers are insured in a timely and affordable manner. We have built a reputation for providing top-notch service through a personalized approach and do not settle for anything less than the best. We specialize in insurance for the small and medium sized trucking companies of Vermont and are here to assist your company in every way we can.

Cover Me Insurance Agency has an experienced staff with over 20 years experience that are ready to help with all your truck insurance needs in all 50 states.

Contact us if you are looking for a truck insurance policy, semi insurance policy, owner operator insurance policy, fleet insurance policy, or a motor truck cargo insurance policy. Give us a call today at 1-800-726-8376 or fill out our free quote form and we will promptly get back to you.

As the owner of a company providing comprehensive commercial truck insurance in Utah, I continually learn about the variety of issues businesses face when operating commercial vehicles. Commercial truck insurance is similar to personal car insurance, but there are a few additional considerations.

As the owner of a company providing comprehensive commercial truck insurance in Utah, I continually learn about the variety of issues businesses face when operating commercial vehicles. Commercial truck insurance is similar to personal car insurance, but there are a few additional considerations.

Imagine you’re driving down the highway when another driver slams on their brakes and rear-ends your vehicle. Or imagine you’re driving to a work conference when another vehicle pulls out into your path. While these incidents may sound far-fetched, they do happen. That’s why it’s important to have commercial truck insurance.

Imagine you’re driving down the highway when another driver slams on their brakes and rear-ends your vehicle. Or imagine you’re driving to a work conference when another vehicle pulls out into your path. While these incidents may sound far-fetched, they do happen. That’s why it’s important to have commercial truck insurance.

If you own a truck, you need commercial truck insurance. It protects not only your truck, but other people on the road and your property. According to TruckingInfo.com, the average cost of insurance for a commercial truck is $2,585 per year. If you’re just paying the minimum, these rates can add up over time. Compare quotes from multiple companies to find the right policy for your truck.

If you own a truck, you need commercial truck insurance. It protects not only your truck, but other people on the road and your property. According to TruckingInfo.com, the average cost of insurance for a commercial truck is $2,585 per year. If you’re just paying the minimum, these rates can add up over time. Compare quotes from multiple companies to find the right policy for your truck.

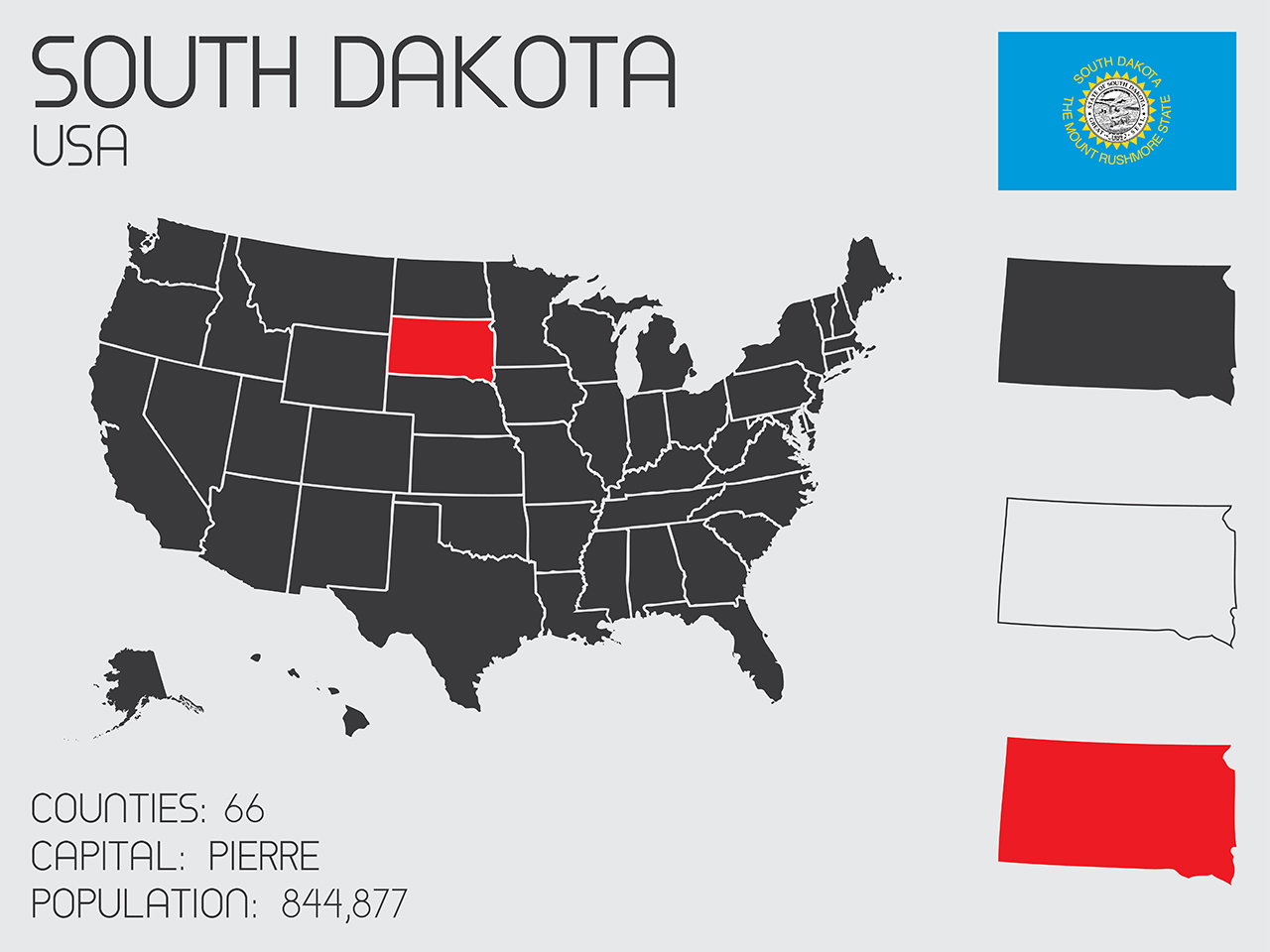

When you’re driving a commercial vehicle in the state of South Dakota, you need commercial auto insurance. Commercial auto insurance is different from personal auto insurance. A commercial auto insurance policy is a liability policy, or a policy that covers you in the event of a liability claim. Commercial auto insurance policies come in three variations: Commercial Auto, Non-Trucking Liability, and Truck Cargo. Commercial Auto is the most basic policy, covering things like bodily injury and property damage. Non-Trucking Liability is a policy that only covers you when driving your personal vehicle, such as when picking up or dropping off a friend. Truck Cargo covers your vehicle and the cargo you carry, such as freight or goods.

When you’re driving a commercial vehicle in the state of South Dakota, you need commercial auto insurance. Commercial auto insurance is different from personal auto insurance. A commercial auto insurance policy is a liability policy, or a policy that covers you in the event of a liability claim. Commercial auto insurance policies come in three variations: Commercial Auto, Non-Trucking Liability, and Truck Cargo. Commercial Auto is the most basic policy, covering things like bodily injury and property damage. Non-Trucking Liability is a policy that only covers you when driving your personal vehicle, such as when picking up or dropping off a friend. Truck Cargo covers your vehicle and the cargo you carry, such as freight or goods.

Commercial trucks move products, merchandise, and supplies across the land. This move is made possible by a commercial truck insurance policy. This type of policy is not the same insurance as your personal car insurance. You need commercial truck insurance when your truck is on the road.

Commercial trucks move products, merchandise, and supplies across the land. This move is made possible by a commercial truck insurance policy. This type of policy is not the same insurance as your personal car insurance. You need commercial truck insurance when your truck is on the road.

Hiring a driver to transport commodities can be risky business – and it’s even worse when that driver is uninsured. That’s why states across the country require businesses, like trucking companies, that provide services to the general public to carry commercial vehicle insurance. Also known as commercial auto liability insurance, this coverage protects the company that employs commercial truckers.

Hiring a driver to transport commodities can be risky business – and it’s even worse when that driver is uninsured. That’s why states across the country require businesses, like trucking companies, that provide services to the general public to carry commercial vehicle insurance. Also known as commercial auto liability insurance, this coverage protects the company that employs commercial truckers.

Staying safe on the roads means covering your bases—and in Oregon, that means having the right kind of commercial auto insurance. Commercial trucks are large, heavy, and often dangerous, so drivers who operate them need to ensure that they are following all the rules and laws that govern them. If you’re a commercial trucker looking for the right insurance policy, make sure you’re covered and know what to do in case of an accident.

Staying safe on the roads means covering your bases—and in Oregon, that means having the right kind of commercial auto insurance. Commercial trucks are large, heavy, and often dangerous, so drivers who operate them need to ensure that they are following all the rules and laws that govern them. If you’re a commercial trucker looking for the right insurance policy, make sure you’re covered and know what to do in case of an accident.

Without trucks, many of our daily goods like food, clothing, and fuel wouldn’t be delivered to us. According to the Bureau of Labor Statistics, more than 2.4 million truck drivers work in the United States, and they haul over 70 percent of the nation’s freight. That’s a lot of cargo!

Without trucks, many of our daily goods like food, clothing, and fuel wouldn’t be delivered to us. According to the Bureau of Labor Statistics, more than 2.4 million truck drivers work in the United States, and they haul over 70 percent of the nation’s freight. That’s a lot of cargo!

Commercial Truck Insurance in Ohio is a must for every trucking company. This insures your business against property damage, bodily injury and property damage liability claims arising from the operation of your commercial trucks. This coverage also pays for defense costs, including legal fees and costs, if you are sued in a lawsuit. A Commercial Truck Insurance policy will cover your semi trucks, dump trucks, box trucks, tanker trucks, garbage trucks, and any truck commonly used for commercial purposes.

Commercial Truck Insurance in Ohio is a must for every trucking company. This insures your business against property damage, bodily injury and property damage liability claims arising from the operation of your commercial trucks. This coverage also pays for defense costs, including legal fees and costs, if you are sued in a lawsuit. A Commercial Truck Insurance policy will cover your semi trucks, dump trucks, box trucks, tanker trucks, garbage trucks, and any truck commonly used for commercial purposes.